Technical Report 2022/04/15

Welcome to the second MELD technical report of 2022 for the progress of the last 45 days!

We have spent much effort researching innovative ideas for our DeFi products and governance system, experimenting with Plutus v2 designs with CIP 31/32/33, developing Akamon the bridge, polishing our UX research, infrastructure and code bases. The vision is to design unique dApp products for the Babbage era and be ready as early as possible when the Vasil hardfork hits. Until then, Akamon will be the first product we focus on launching.

Akamon (Previously ADAmatic)

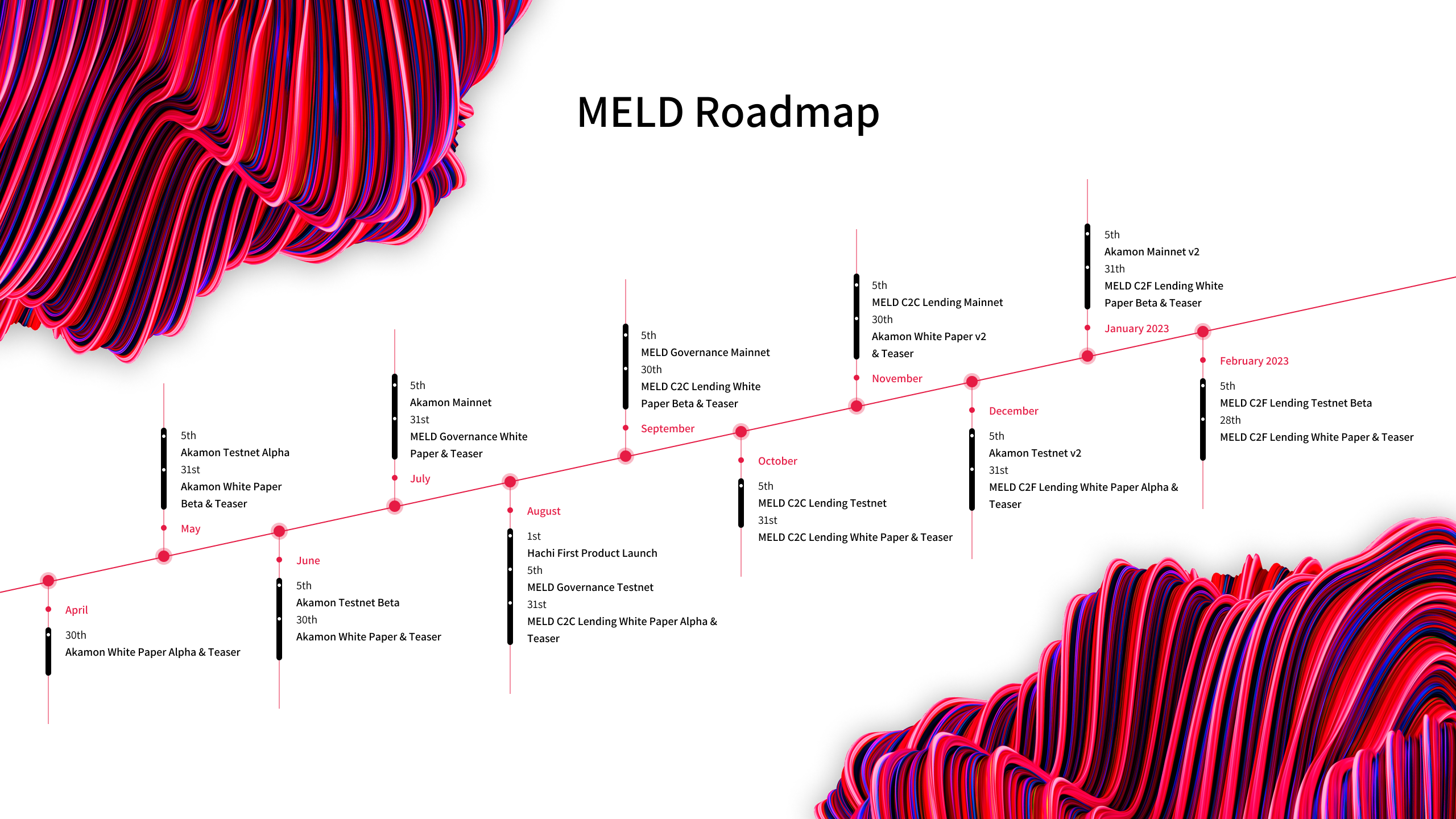

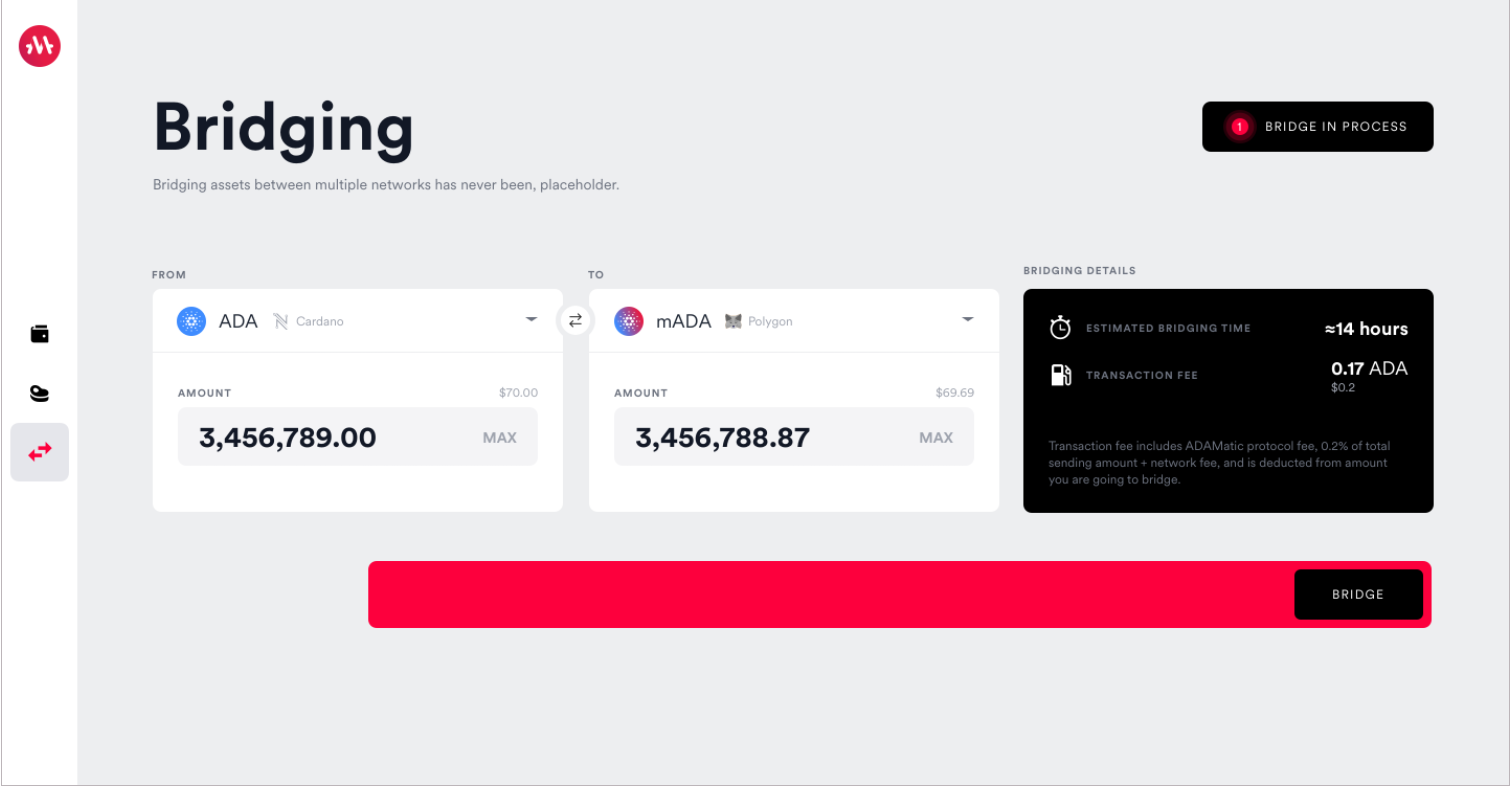

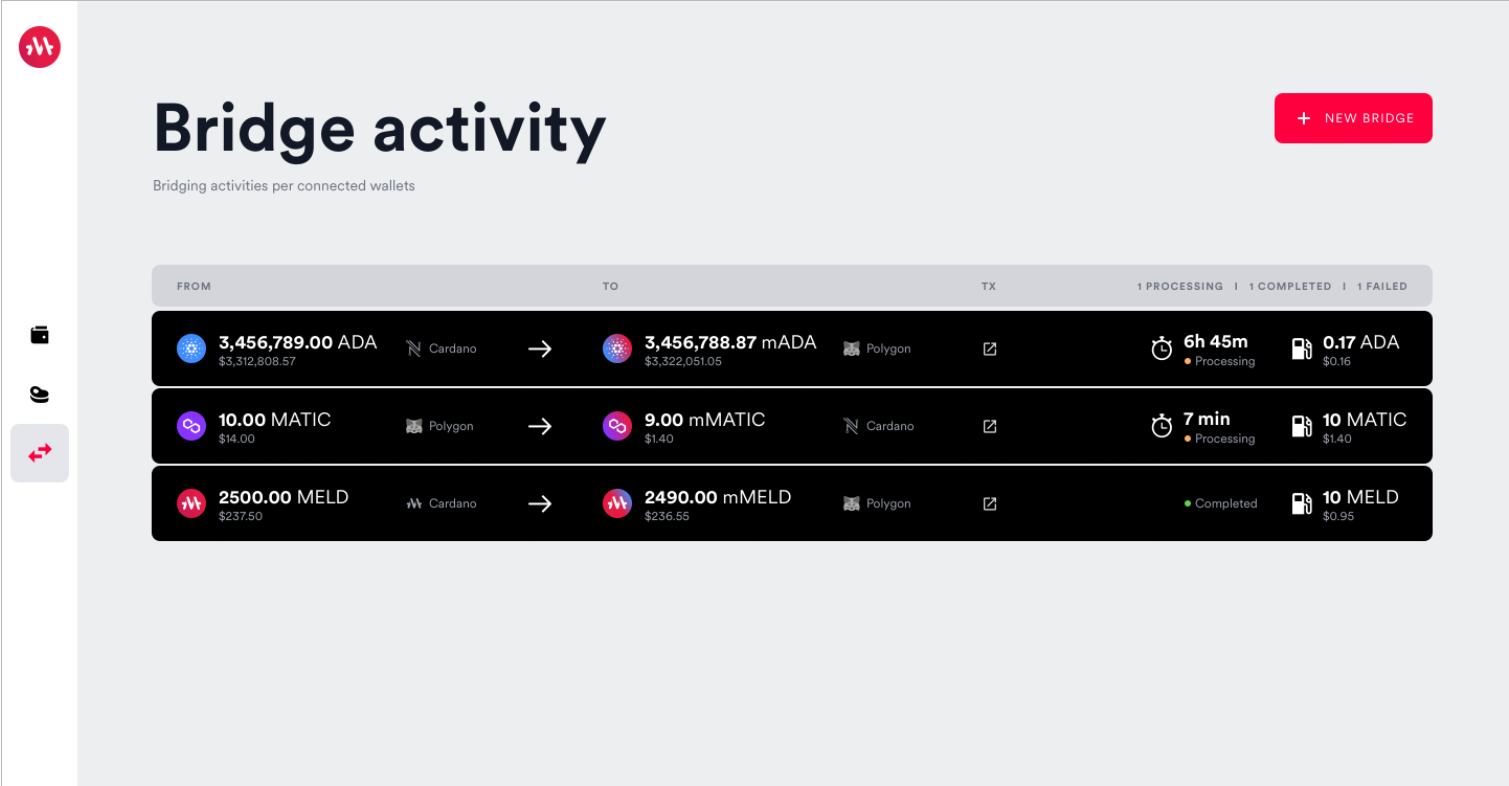

We have been working on two different versions of the bridge, an alpha without smart contracts and a beta with them. We expect to launch the alpha on testnet on May 5th and the beta on testnet on June 5th. After two months of both security and UX testing on the testnet, we will launch the first version of the bridge on mainnet on July 5th.

In December, we will launch a second version with superior designs built on top of the Vasil hard fork to testnet. We also aim to support native wrapping for more networks by then. Although design work has started, we need to be more patient for better Plutus v2 tooling for prototyping and verification.

Another critical line of work is to do security research with Hachi on both Cardano and blockchain bridges. Most brutal hacks in crypto thus far are on bridges, so we cannot take this lightly. A network’s on-chain is another network’s off-chain. It is non-trivial to have tight consensus and scalability when dealing with multiple networks. For now, we are surveying common bridges exploits and vulnerabilities to define security standards and checks for Akamon. The goal is to specify the bridge formally and write machine proofs for as many properties as possible.

Why Akamon again? The goal is to improve capital efficiency and token choices from different networks for the MELD protocol and the broader DeFi ecosystem. Our core product aims to bridge crypto and fiat and decentralise the process as much as possible. It makes much sense to extend the reach in the crypto world while making sure tight standards are met throughout the whole flow.

More information will be covered in the first public white paper and teaser video to be released this April 30th. Stay tuned!

MELD Lending

We have been spending a significant amount of effort on designing a suite of DeFi protocols on top of our lending foundation. Crypto-to-crypto has been more or less saturated recently, so we cannot simply develop an Aave or Anchor clone on Cardano. Instead, we have explored new ways to utilise smart contracts to enable under-collateralised loans. We have been working on diverse ideas ranging from a credit market with gamification, and asset management protocol, all the way to a brand new DeFi standard on UTxO that allows under-collateralised loans that do not leave the contracts that support it. We also have fresh ideas for new DeFi protocols that we may develop ourselves for the standard.

Given the innovative and experimental nature of the ideas, we still need much more time to formalise, simulate, and prototype them on the blockchain. Given their ambition and complexity, we would need all the new features and optimisations from the Vasil hardfork to pull them off. We will release the first white paper and teaser video this September. Hang tight!

We have been working hard on preparations for the fiat integrations, especially concerning legal and operations. We expect to release the first public white paper and teaser video on crypto-to-fiat this December, with a testnet launch planned for February 2023. Similar centralised services have been progressing well lately, making us even more determined to push for more decentralised solutions. The non-profit MELD Foundation is being set up for that exact reason.

Cardano

Since the last technical update, we have had two workshops with the Plutus Apps team.

The first one is scaling PAB, especially the chain index, which is still slow and resource-intensive. Previously, we were building our own meld-index on top of plutus-chain-index-core to serve chain data to the MELDapp. However, things get verbose every time we want to extend meld-index and build new solutions like akamon-index, quant-index, hachi-index, and more. Therefore, we have been building a rather opinionated yet assertive cardano-index framework to replace plutus-chain-index-core so everyone is only a few modules away from having a solid index syncing to PostgreSQL with builtin rollback handling. The key is to factor out the syncing framework, so dApp developers only need to define their data types and business logic in the few extra modules.

The second workshop is on our dapp-starter template with full testnet deployment and Nami integration. Educational resources like the Plutus Pioneer Program have not covered many infrastructure and off-chain topics, making it hard for new developers to deploy dApps and integrate them with external wallets. We also desire a tight template for the many smart contracts we are developing and a rich playground of diverse samples to experiment with new tooling (MELD and Hachi’s!) and ideas. It has proved very helpful to our interns thus far.

Our tooling suite also contains cardano-api-extra and cardano-tx-builder – lightweight and low-level API for extra Cardano functionalities and building transactions. While cardano-api-extra is utilised by several, mainly off-chain codebases as a low-level API, cardano-tx-builder aims to provide a low-level API to build transactions and a webserver to do so over HTTP. Our main goal is to replace the currently bloated PAB setup with a leaner one of cardano-index and cardano-tx-builder.

Staying lean (depending directly on cardano-api, cardano-ledger, and plutus) promises a faster Plutus V2 integration process. We have been designing many dApps with CIP 31/32/33 in mind and want to prototype them as soon as possible. We have compiled Plutus V2 validator scripts with CIP 31/32/33 using the latest plutus and cardano-ledger works. However, we still need to be more patient for cardano-node and plutus-apps to catch up and write better testing frameworks ourselves. One may follow these threads if interested in Plutus V2 integrations:

Once both Akamon and Plutus V2 integration get stable enough, we would love to explore more ideas like Hydra integration. We would also fancy open-sourcing these generic toolsets to the community once they are mature enough.

In conclusion, we have been anticipating an exciting Vasil hardfork and designing unique dApps accordingly. While developer experience, recruitment, and training for Cardano works are still challenging, we have been recording gradual progress as we build a more vital workforce on Cardano.

Hachi

As per the last report, Hachi has focused on practical tooling for dApp developers over pure research like in the early days. We have made several improvements to our Plutus transpilers, symbolic execution engine, concolic execution engine, fuzzers, and other helper tools. A Hachi API and an infrastructure to host it have also been the central focus to improve the interface between dApp developers and Hachi’s analysis stack. The goal is to build a developer-friendly API to automatically verify dApp’s properties and find bugs in Plutus scripts. While much progress has been made, the project is still non-trivial and would require at least another quarter to reach a public alpha.

Recently, MELD has joined hands with Hachi to do security research relevant to the Akamon bridge. We cannot wait to specify the bridge formally and automatically verify it with Hachi API – the gateway to several analysis tools for Plutus.

We are also finding common grounds to deepen our working relationship with Tweag. On another end, we continue to join IOG’s security workshops and cannot wait to join the first in-person conference next month in Barcelona.

Please follow the Hachi blog for more information.

Economics

The economics team’s primary responsibility is surveying all the relevant blockchains and DeFi protocols to understand the market and better design the economics and tokenomics of MELD products. We currently have several products built on our lending engine to design, simulate, and optimise. Given their research and academic-driven background, the economics team plays a massive role in formalising the products and simulating them with data. Concrete results will be included in the upcoming white paper releases.

The economics team has also been working on and writing several economic proposals to protect the MELD token’s price and create healthy markets. Another critical responsibility is treasury management to ensure the project utilises its capital well for the many years ahead.

We also seek to build a tight data infrastructure for quantitative and economics modelling. It is not trivial to build one on Cardano, but our advances on cardano-index seem very promising. Hachi’s low-level research on the automatic inference of (not so complex) datum types to simplify security properties may be applicable here; to accurately track DeFi data to every detail, even for projects that have not open-sourced their code.

MELDapp

Our major win lately was building a better UX research and design approach. While much more time is still required to formalise the process, we continue to aim for the best DeFi experience. Another win has to do with several improvements to our whole backend infrastructure. Much effort has been made to ensure we have the best infrastructure for development, staging, and production environments. Both works have been critical as we expand our development scopes and seek to launch several products towards the end of the year.

For now, the number one task is to complete the Akamon integration for the first testnet launch in May. The MELD Governance suite of variable staking, protocol fees sharing, and voting on protocol proposals are right after. As we release additional functionalities, we also plan to release more wallet support on Cardano, Polygon, and more networks as Akamon grows its reach.

Conclusion

The past 45 days have been foundational to further stabilising the teams, products, tooling, and development processes. We are now looking forward to an aggressive roadmap of monthly launches and updates. We expect to launch on the 5th, post a technical update on the 15th, and post a white paper update and a teaser video on the last day of every month. Hang tight!